Home » Blog » Banking in Early Geneva

Banking in Early Geneva

February 5th, 2014

By Anne Dealy, Director of Education and Public Information

During the five years since the recession started, there has been a lot of ink and talk devoted to banking and financial matters. This past year also marked the anniversaries of two changes in American banking that transformed our financial system. These are the 100th anniversary of the creation of the Federal Reserve last December and the 150th anniversary of the National Banking Act in February 2013. In this post, let’s look at banking in Geneva prior to the establishment of a national financial system.

|

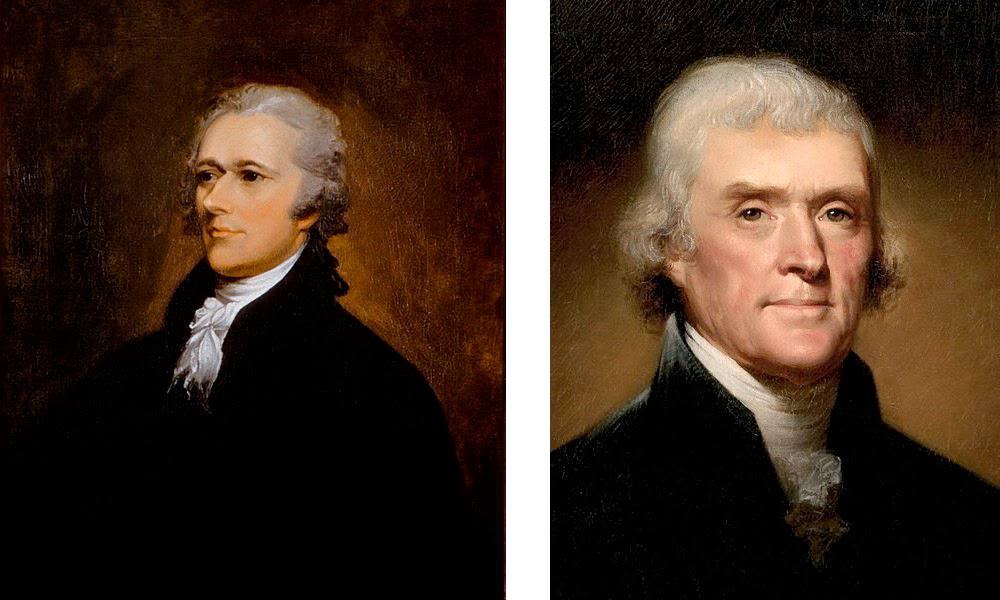

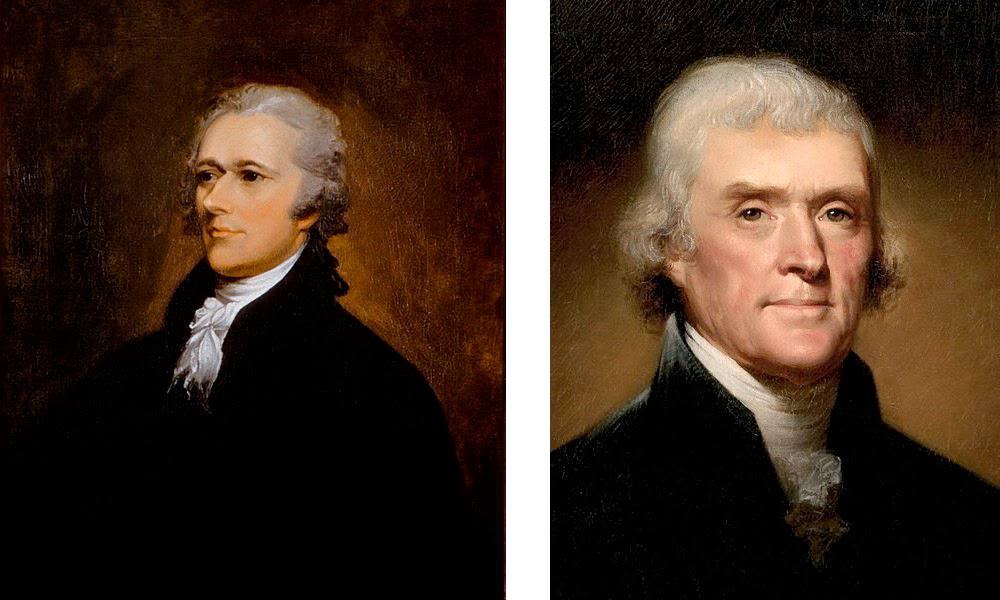

Thomas Jefferson and Alexander Hamilton had fundamentally different ideas about

money and banking in the new United States.

White House Historical Association Collection. |

Banking during Geneva’s first 70 years was quite different from the modern American experience. During this period, there was no national currency or central banking system. Americans had a strong prejudice against paper money following the devaluation of Continental dollars printed to finance the Revolutionary War. While the Constitution gave the federal government the power to coin money, there was strong disagreement about its powers to regulate banking. These arguments were personified in Thomas Jefferson and Alexander Hamilton, who held opposing views on the strength and role of the central government, especially in terms of finance. Hamilton’s success in creating a national bank was short-lived, and the power to regulate finance was left to the individual states. For New York, this regulation was heavily influenced by Hamilton, who founded the nation’s very first bank, the Bank of New York, in New York City in 1784.

|

The national government produced only coins in the early Republic, like this 1804 $1 coin.

National Numismatic Collection, Smithsonian. |

In our colonial and early national history there was a nearly constant shortage of cash. Gold and silver were in short supply for coins. As a result, Spanish, French and English coins were used as legal tender into the mid-19th century. Many people, especially in frontier areas like the Finger Lakes, operated in a cashless economy, trading their produce or labor for credit with local merchants. Merchants would carry a debt on account until a crop was harvested or an item brought in for payment. The problem with this system was that the merchant had his assets tied up in these debts, limiting his ability to purchase goods from importers and manufacturers in the east. Merchants needed forms of cash or credit that would be recognized by strangers in other communities. Banks filled this need.

|

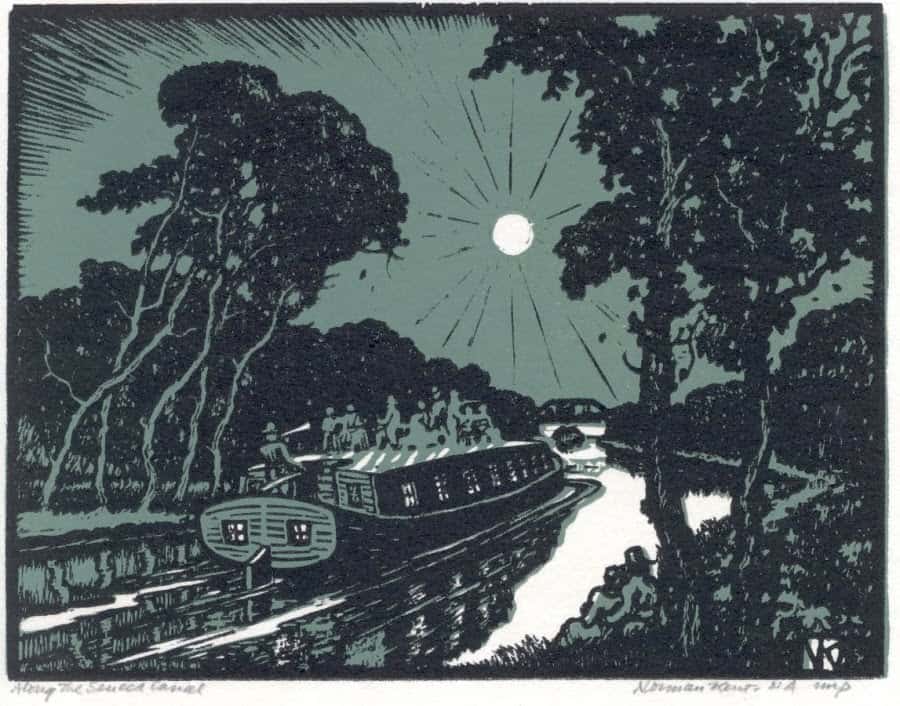

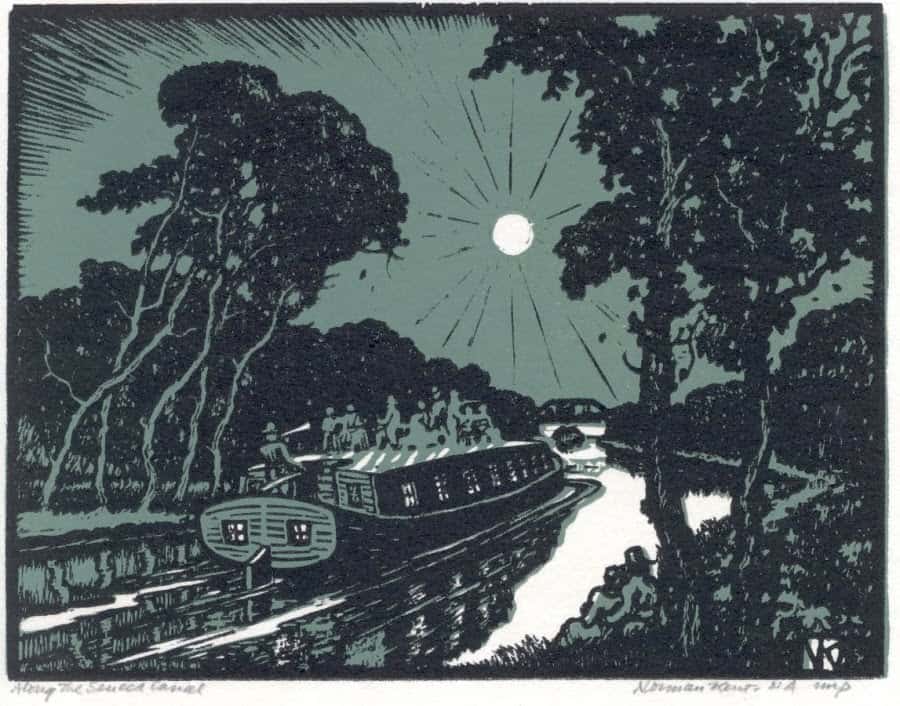

| Geneva’s growth was tied to transport and commerce, as noted in this 1942 print by Norman Kent commissioned by the National Bank of Geneva for its 125thanniversary. |

For western communities, a bank was necessary for growth and development. By 1815 there were banks in Utica, Auburn and Canandaigua, but not Geneva. With the lake and turnpike traffic coming through Geneva, a bank was essential to the community’s continued prosperity. In 1817 a group of stockholders applied to the state for a charter to start a bank. The charter was granted by the State Legislature on March 28, 1817, and the Bank of Geneva began business.

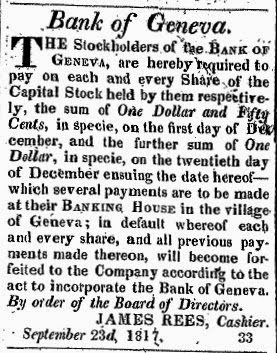

|

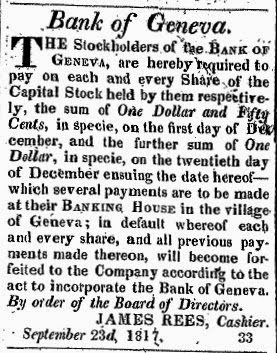

Once bank shares were sold, the bank had to collect the money promised

to gain its capital. |

The bank’s founding shows the difficulty of raising capital in this environment. Most banks were financed by the savings and assets of a small group of men who purchased shares in the bank. They would then divide the profits if the bank succeeded, or lose their money if the bank failed. The Bank of Geneva had a charter to hold $400,000 in capital, so the Directors wanted to sell 20,000 shares for $20 each to procure the necessary capital. After five months, they had only sold about 6,000 shares. The bank was rescued by Henry Dwight, a wealthy young minister from Utica, who bought the remaining shares for $14,100 in specie (coin). He was promptly elected President of the Bank, which he ran successfully for the next 22 years, weathering the frequent depressions which bankrupted many other institutions.

|

The Bank of Geneva’s first location was what is today the rectory of

Trinity Episcopal Church on South Main Street. |

One aim of the bank was to make a profit for the stockholders. An equally important part of its business was to get its notes circulated to enable other businesses to thrive. These notes were distributed mainly through short-term discounted loans. Unlike loans in which a borrower receives money at a specified rate and returns the principal plus interest, in these transactions the bank loaned money at a discount. That is, a borrower getting a $100 loan at a 6% discount would get $94.34 and repay $100 when the loan came due. The money loaned would be given in the form of notes, which could be redeemed by anyone who brought them back to the issuing bank for specie. What every bank wanted was for their notes to be used to pay workers and buy materials, property or goods, and not be returned for redemption. This allowed them to make loans in excess of the capital they held in the bank itself. When too many notes were returned for redemption, a bank could exhaust its capital and fail. Key to a bank’s success was carefully balancing the amount in notes released and redeemed, with the capital on hand. Banks competed fiercely, each trying to keep its bills in circulation while redeeming all those of other banks bills for specie.

|

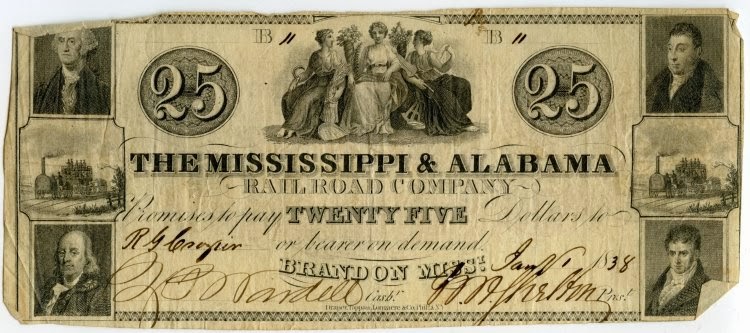

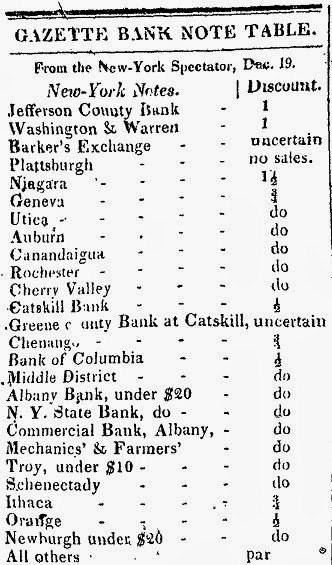

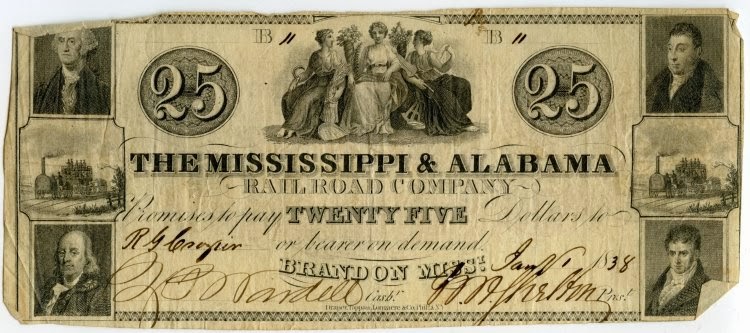

| The uncertain value of bank notes from far-way communities made using them risky. |

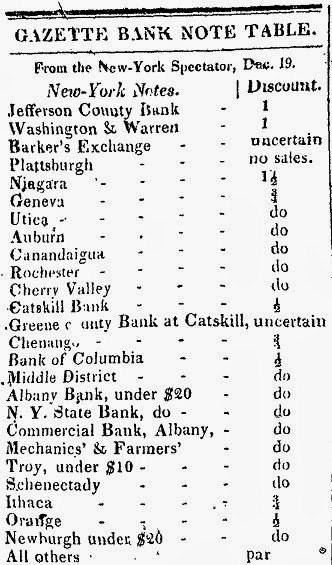

Since banks were generally confined to one community, the farther away the notes went, the harder it was to redeem them. Merchants and banks would have to take notes in payment from banks in other cities and states, and it was difficult to know if those bank notes were worth the printed value. As a result, the notes of some banks were accepted at face value, while others were exchanged at a discount. Notes from Geneva and other western New York banks were discounted at 0.5% in New York City, so a $10.00 note was worth $9.95 out of town. To keep track of these rates, tables of the discount on various bank notes were published in newspapers and books.

|

|

Table of discount rate for notes from New York banks, Geneva Gazette, 1826.

|

Prior to the Civil War, the Bank of Geneva was the only successful bank in the village. William Strong, the builder of Rose Hill Mansion, started the Farmer’s Bank of Geneva in 1839, but it was unprofitable and closed by 1841 without loss. Several others failed outright. Banking in Geneva remained a one-institution business until the National Banking Act, passed to fund the Civil War, allowed the federal government to regulate banking and the money supply. Under this act, the Bank of Geneva was re-formed as the Geneva National Bank. In the subsequent years of phenomenal national growth, new institutions formed and began to provide more financial services to Geneva’s residents, which I will cover in a future post.

For further information: